It gives you a more realistic idea of your business’ income and expenses during a period of time and provides a long-term view of the business that cash accounting can’t provide.

Ericas insights into personal and business finance have been cited in numerous publications.

HOW IS OWNERS PAY AND PERSONAL EXPENSES IN QUICKBOOKS TAXED HOW TO

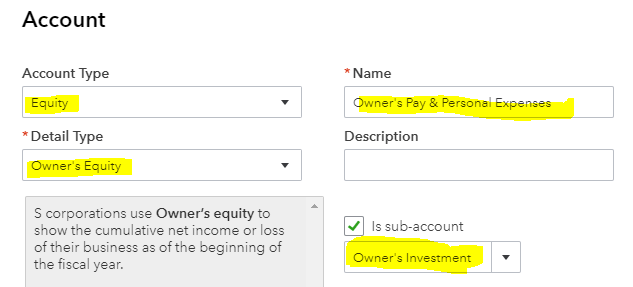

Generally speaking, accrual accounting is better for larger, more established businesses. Then we’ll go over how to pay users using direct deposit. Same goes for expenses, which you record when you’re billed in the form of accounts payable. Using the accrual accounting method, you record income when you bill your customers, in the form of accounts receivable (even if they don’t pay you for a few months). 2) Business Expenses paid from a Private Bank Account (or Credit Card). So you are not selecting an expense account, but the liability account. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal. Many small businesses opt for the cash basis of accounting because it’s easy to maintain, doesn’t require you to track receivables or payables, and tells you exactly how much cash you have on hand at any given point in time. Any time a personal expense comes through on your business account, book them as Drawings (as you are effectively drawing money out of the business by paying for your personal things). If you bill a customer today, those dollars don’t enter your ledger until the money hits your bank account. There are not many small businesses that form as C Corporations. C Corps are Double-Taxed as Their Salaries & Profits are Taxed. If youre the sole owner of a company, no law prevents you from using business funds for personal expenses. Business owners spend much of their time at the office as well as working at home. The IRS frequently audits S Corporations, and closely reviews expense deductions and taxes paid. For the owner of a business, it can be easy to lose track of the line between work and personal life. Avoiding tax confusion Depending on your business structure, you might be able to pay yourself a salary and take an additional payment as a draw, based on profit for the. Under cash accounting, you record transactions only once money has exchanged hands. S Corp shareholders need to be very careful about co-mingling personal and business expenses. If Patty takes a 100,000 owner’s draw right now, her catering company may not have enough money to pay for employees’ salaries, food costs, and other business expenses. Then when you are ready to pay a portion of the current statement, you simply enter a bill for the amount you wish to pay and expense. Step 1: Record a personal expense from a business account. After that, you can reimburse the company. When you use a business account to pay for a personal expense, you should record it in QuickBooks.

You have another important decision to make when setting up your bookkeeping: whether to make your accounting process cash or accrual based. Even though you should avoid mixing personal and business funds, sometimes it happens.

0 kommentar(er)

0 kommentar(er)